Let’s make sure that, come tax time, you add those new work related expenses on your tax return. You can use the fixed-rate or shortcut method which will supply you with a set rate of deductions. However, if you have a lot of expenses and are great at tracking you can calculate it manually within the actual expenses method. This decline in value will be calculated and be spread over the item’s perceived lifetime, essentially writing off the cost over several years. This is called depreciation, and we recommend you seek tax advice around this.

From1 January 2023, fines will jump from $222 to $275 per penalty unit, a 19.3 per cent increase. With Single Touch Payroll Phase 2 reporting now well underway, small business employers need to remember their next reporting deadline is 1 January 2023. People with physical or mental disabilities that limit their ability to be employed can deduct expenses necessary for them to work from home, including attendant care. You must have a record of the hours you worked from home, for example, a timesheet, roster or diary. Can't claim any other expenses for working from home, even if you bought new equipment. You will need to meet the eligibility and record keeping requirements for the method you choose to use.

Using ato.gov.au

Work-related expenses will continue to look different from the pre-COVID time for a while yet. As the ATO is progressing on processing 2021 Tax Returns, they are taking a special interest in work from home deductions. From 1 July 2022, employers must make SG contributions at 10.5% for eligible employees regardless of how much they earn afterremovalof the $450 per month eligibility threshold.

We understand that due to COVID-19 your working arrangements may have changed. If you have been working from home, you may have expenses you can claim a deduction for at tax time. Claim the actual work-related portion of all your running expenses, which you need to calculate on a reasonable basis.

ATO Social

Whether you work for yourself or are involuntarily working from home, let’s dive into the different categories available as claiming expenses. Please give us a call if you have any queries about what you can & can’t claim or what records to keep. The previous grandfathering of the exemption applying to certain large proprietary companies from the normal obligation to lodge their annual reports with ASIC was also removed. Taxpayers running afoul of the taxman will find themselves facing bigger bills this year after the Federal Budget included measures to increase the fines for regulatory penalty units.

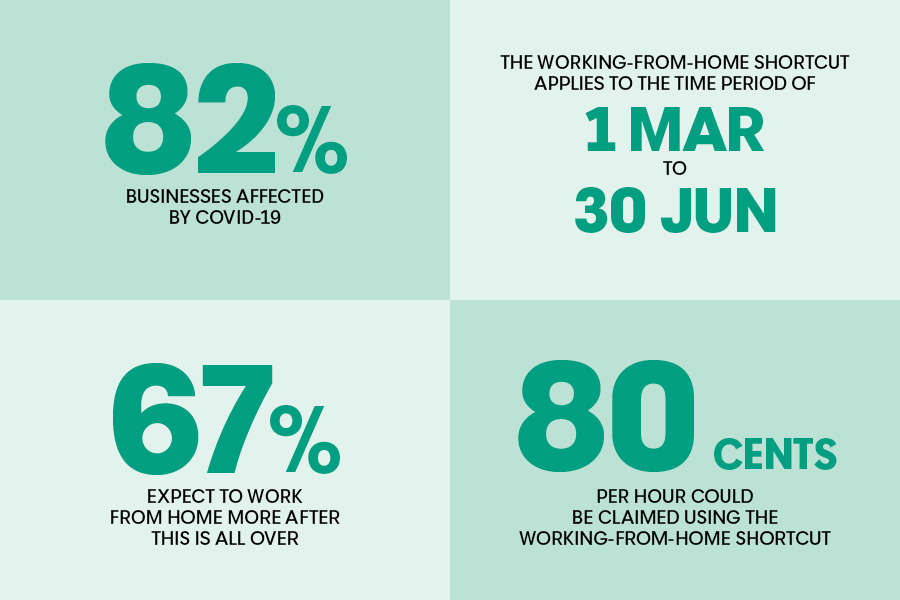

Claim a rate of 80 cents per work hour for all additional running expenses. She also wants to claim some additional gas, electricity, phone and internet costs due to working from home. The rate of 52 cents per hour applies in the periods from 1 July 2018 to 30 June 2022. A home office is a designated room or area in your home set aside just for work that is not shared by other people and not used for other purposes. So basically, your kitchen table or the desk in your living room aren’t going to cut it as a home office in the eyes of the ATO.

Calculate your work from home deduction

However, even if you’re not one of these, there are still a few possible ways for you to get tax deductions from your expense for working from home. A financial advisor can help you find every deduction and credit you are entitled to. Expenses for working from home are not deductible for most employees since the 2017 tax reform law. For people filing for tax years before 2018 work from home deductions can be used. Also, the current limitation on deductions is set to expire in 2025, so after that tax year expenses for working from home will again be deductible for many employees.

The employer will then be able to deduct the reimbursements as business expenses. Once you calculate your deduction, enter the amount at Other work-related expenses in your tax return. If you’re entitled to goods and services tax input tax credits, you must claim your deduction in your income tax return at the GST exclusive amount.

Another claim ruled out concerned the cost of setting up children for homeschooling. Someone didn’t actually want their dog at home because it’s too destructive, so they decided they were going to try to claim doggy daycare. “We’ve seen claims for toilet paper, tea, coffee and biscuits because ‘if they’re provided at work then you should be able to have them at home’. As working from home is now the single largest source of deductions, the ATO won’t allow anything that falls outside its guidelines.

Claims for working from home expenses prior to 1 March 2020 cannot be calculated using the shortcut method, and must use the pre-existing working from home approach and requirements. “This recognises that many taxpayers are working from home for the first time and makes claiming a deduction much easier. For example, a couple living together could each individually claim the 80 cents per hour rate.

Shortcut method 80 cents per hour for all costs, from 1 March 2020 to 30 June 2022. Draft Practical Compliance Guideline PCG 2022/D4 sets out the basis of a revised fixed rate method to apply from 1 July 2022. To establish a claim of more than $50, a 4-week representative period of expenditure can be used to establish a percentage claim of the total cost of calls and data contained in itemised billing records. Records include diary entries, electronic records, and bills, along with some evidence from the employer that work from home or work-related calls are expected. Apportioned business internet usage can be estimated based on records of actual usage maintained for the year or in stable usage circumstances a representative 4 week period will suffice.

The requirement to have a dedicated work from home area has also been removed. Under the 80 cents method the only records required to be kept are time records, showing the hours worked from home, and there is no requirement for a dedicated work area. Claims for periods from 1 March 2020 can be calculated at the rate of 80 cents per hour. The 52 cents and 80 cents fixed rate methods are available up to 30 June 2022. This method means, you claim 80 cents per hour for every hour worked at home.

This gives you a fixed rate of 52 cents per hour worked at home deduction. The fixed rate method is great if you have your own dedicated work area, phone and your own internet for work. The original 52 cents per hour method does not include other expenses such as, phone and internet costs, computer consumables, stationery or the work related portion of the decline in value of office equipment. You claim each of those items separately, and usually get a bigger refund. We go into more detail with examples of this on our dedicated “working from home due to COVID-19” article.

This does not apply to any equipment purchased for other members of your family, such as an iPad for homeschooling your kids. For new employees who are offered choice of super fund but fail to choose, you mustrequesttheir stapled super fund details from the ATO to meet your super obligations. Large private business entities will face more scrutiny of their tax affairs after newlegislationpassed through Parliament to require greater transparency of the tax affairs of private companies.

Your tax return

However, if you take the ATO’s advice, then you can’t add your other expenses on top. But you can work with a tax agent to deliver this return – and it has the potential to save you more money than the other methods. If you run your own business from home but don’t have a dedicated workspace, then you will be able to claim the remaining portion of expenses, as long as they’re directly related to working from home.

The fixed-rate method for home office expenses is a lot simpler than the actual cost method and eliminates the need to figure out the exact work related portion of bills or per hour costs. Almost one-in-five taxpayers have taken advantage of the temporary work from home shortcut method to claim deductions, which was introduced as work patterns changed during the pandemic. Self-employed independent contractors also get a number of deductions that are not available to employees, including those among the exceptions. Those can include outlays for utilities, insurance and depreciation of assets including computers and real estate. Prior to 2017, salaried employees could deduct expenses required to perform their duties from home. Reasonable expenses might include travel and entertainment, office furniture, computers and other tools of whatever trade they plied.