Table of Content

Anyone who works from home full time or has had to because they cannot go to an office. Whether you have a home office or not, you can still claim some expenses. Unless they’re supplied by your employer, all of equipment can be rolled into your home expenses.

Much like all of the other categories, these supplies could also be used for non-work related purposes so it’s important to only claim deductions on reasonable quantities of use for your role. For example, buying 200 printer ink cartridges in the space of a month as a copywriter to claim a deduction on all of these purchses is likely to be flagged in your tax return, which may result in an audit. Claiming a tax deduction for home office expenses isn’t as simple as saving receipts for every purchase and adding them into your tax return. There are several categories of both large and small expenses which can be claimed back as work related. The ATO is watching out for people still claiming travel expenses and laundry expenses even though they’re working from home full time.

Expenses you can't claim

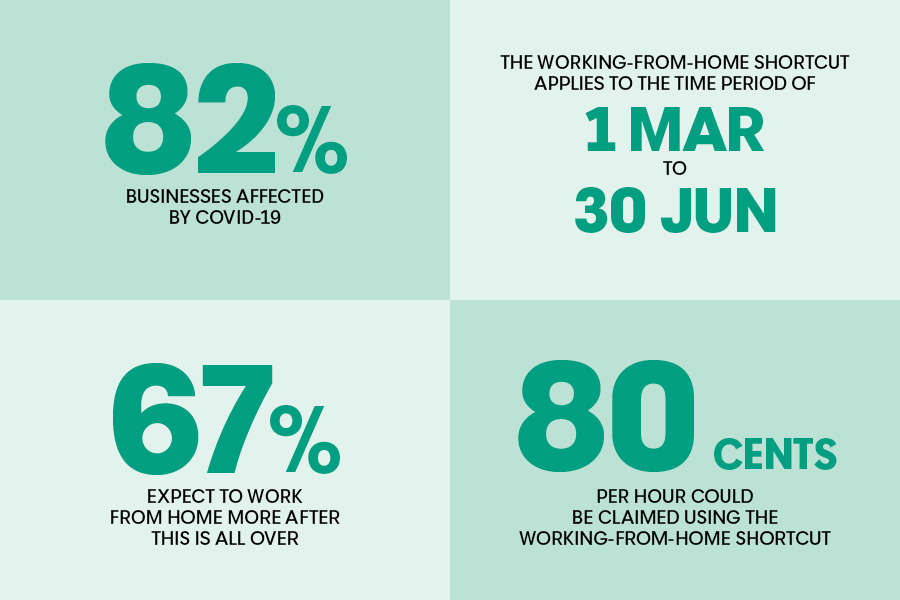

Shortcut method 80 cents per hour for all costs, from 1 March 2020 to 30 June 2022. Draft Practical Compliance Guideline PCG 2022/D4 sets out the basis of a revised fixed rate method to apply from 1 July 2022. To establish a claim of more than $50, a 4-week representative period of expenditure can be used to establish a percentage claim of the total cost of calls and data contained in itemised billing records. Records include diary entries, electronic records, and bills, along with some evidence from the employer that work from home or work-related calls are expected. Apportioned business internet usage can be estimated based on records of actual usage maintained for the year or in stable usage circumstances a representative 4 week period will suffice.

Aside from the benefits of convenience and work/life balance it can afford, working from home can result in you paying less tax. This article highlights what expenses you can claim whilst working from home as tax deductions and how to complete your tax return using the actual cost method, fixed-rate method and shortcut method. Importantly, the running expenses rate does not include items like phone, internet, office furniture or computer depreciation. The 2017 tax reform law ended the ability for most taxpayers to deduct expenses for working from home just in time for millions more people to begin working from in response to the Covid pandemic. Nowadays only a few select groups of salaried home-based workers can still deduct relevant expenses.

ATO tenders and procurement

Claims for working from home expenses prior to 1 March 2020 cannot be calculated using the shortcut method, and must use the pre-existing working from home approach and requirements. “This recognises that many taxpayers are working from home for the first time and makes claiming a deduction much easier. For example, a couple living together could each individually claim the 80 cents per hour rate.

However, some groups of employees may still be able to take these deductions. And self-employed independent contractors still can deduct expenses for home offices. Employers may be able to reimburse employees for necessary expenses and then deduct the outlays as business costs. The new arrangement will allow people to claim a rate of 80 cents per hour for all their running expenses, rather than needing to calculate costs for specific running expenses. If your home is not a place of business, then your claims are restricted to running expenses only. This may include a portion of your heating, lighting, and telephone, electricity consumption, internet expenses and depreciation and repairs of equipment.

ATO Watching Work From Home Deductions Closely

The ATO introduced what they call the Shortcut Method for claiming running expenses during COVID-19. If you are working from home on a temporary basis , it’s likely you would claim running expenses, rather than occupancy. Some will cover equipment however if they are remote company, they may not. Any expenses not covered by your employer, you may be able to can claim back.

If you choose to use this method there is no requirement to separately calculate the decline in value of equipment or depreciating assets or any other working from home expense. If you operate some or all of your business from home, you may be able to claim tax deductions for home-based business expenses. Occupancy expenses relating to your home, such as rent, mortgage interest, property insurance and land taxes, will not become deductible merely because you are required to work from home due to COVID-19. Because your occupancy expenses are not deductible, working from home during COVID-19 will not disqualify you from claiming the capital gains tax main residence exemption when you sell your home.

Key tax topics for Super

If you’re ready to find an advisor who can help you achieve your financial goals,get started now. Determining whether a worker is an employee or independent contractor can be complicated and the IRS makes the determination on a case-by-case basis. However, generally speaking, if a worker receives a W-2 statement showing wages paid and taxes withheld, he or she is an employee.

Let’s make sure that, come tax time, you add those new work related expenses on your tax return. You can use the fixed-rate or shortcut method which will supply you with a set rate of deductions. However, if you have a lot of expenses and are great at tracking you can calculate it manually within the actual expenses method. This decline in value will be calculated and be spread over the item’s perceived lifetime, essentially writing off the cost over several years. This is called depreciation, and we recommend you seek tax advice around this.

The most obvious answer to this is, of course, the money you can save from work from home tax deductions. However, understanding exactly what additional running expenses you can claim on your tax return could open your eyes to new opportunities to further your career or business. Whether that be building your knowledge, giving you the opportunity to try tools or upgrading your home office equipment, understanding the deductions that the Australian Taxation Office allow is important. Since then, this hybrid way of working has continued to play a core role in the very structure of our working economy. What this shift has also showed is how beneficial working from home can really be, encouraging those who are used to the office lifestyle to negotiate time to work from home as an employment benefit.

Tracking your working from home expenses can be challenging, so we introduced a temporary shortcut method. It's a simple way to calculate these expenses with minimal record keeping requirements. The temporary shortcut method initially applied from 1 March to 30 June 2020, however it can now be applied up until 30 June 2022.

Another claim ruled out concerned the cost of setting up children for homeschooling. Someone didn’t actually want their dog at home because it’s too destructive, so they decided they were going to try to claim doggy daycare. “We’ve seen claims for toilet paper, tea, coffee and biscuits because ‘if they’re provided at work then you should be able to have them at home’. As working from home is now the single largest source of deductions, the ATO won’t allow anything that falls outside its guidelines.

Claim a rate of 80 cents per work hour for all additional running expenses. She also wants to claim some additional gas, electricity, phone and internet costs due to working from home. The rate of 52 cents per hour applies in the periods from 1 July 2018 to 30 June 2022. A home office is a designated room or area in your home set aside just for work that is not shared by other people and not used for other purposes. So basically, your kitchen table or the desk in your living room aren’t going to cut it as a home office in the eyes of the ATO.

Paying the ATO

The expenses of motor vehicle trips between your home and other locations, if the travel is for business purposes. If you're a sole trader or business owner and your home is your principal place of business, see Deductions for home-based business expenses. Employees working from home may be able to claim a deduction for the expenses you incur relating to your work. Claims for working from home expenses prior to 1 March 2020 should be calculated using the existing approaches and are subject to the existing requirements.

No comments:

Post a Comment